General News

20 November, 2024

Rodeo creditors put on hold as administrator waits for LNP decision

SV Partners will call for more time on Monday as the new state government ponders a bailout.

Businesses owed money by Isa Rodeo Ltd will be asked to postpone a final decision on the organisation’s future as the new LNP government weighs up whether to provide a financial parachute.

Creditors are scheduled to meet on Monday after they were last week delivered a damning report from administrator SV Partners which highlighted the poor financial management of Isa Rodeo Ltd over a number of years.

Because the LNP has yet to make a call on whether it will provide a financial stimulus to one of Outback Queensland’s most iconic events, SV Partners will ask the creditors for more time and to adjourn the meeting before settling on a Deed of Company Arrangement.

“The scope of our investigation into the affairs of the company has been limited by the time constraints imposed by the Act and the quality of records provided,” SV Partners said in its creditors report.

“An adjournment of the meeting will enable us to attend to ... further negotiate with key stakeholders to identify the possibility of presenting a Deed of Company Arrangement for creditors that would present a better return than if the company were placed into liquidation.

“We believe these matters are critical to the administration and the adjournment is in the best interest of creditors.”

Under the Corporations Act, the meeting can be adjourned for a period of up to 45 business days. North West Weekly understands that if the creditors vote against an adjournment, SV Partners would recommend that creditors resolve that the company be wound up.

With Isa Rodeo Ltd’s shortfall now more than $1 million, creditors would receive less than 50 cents on the dollar if the company was made insolvent.

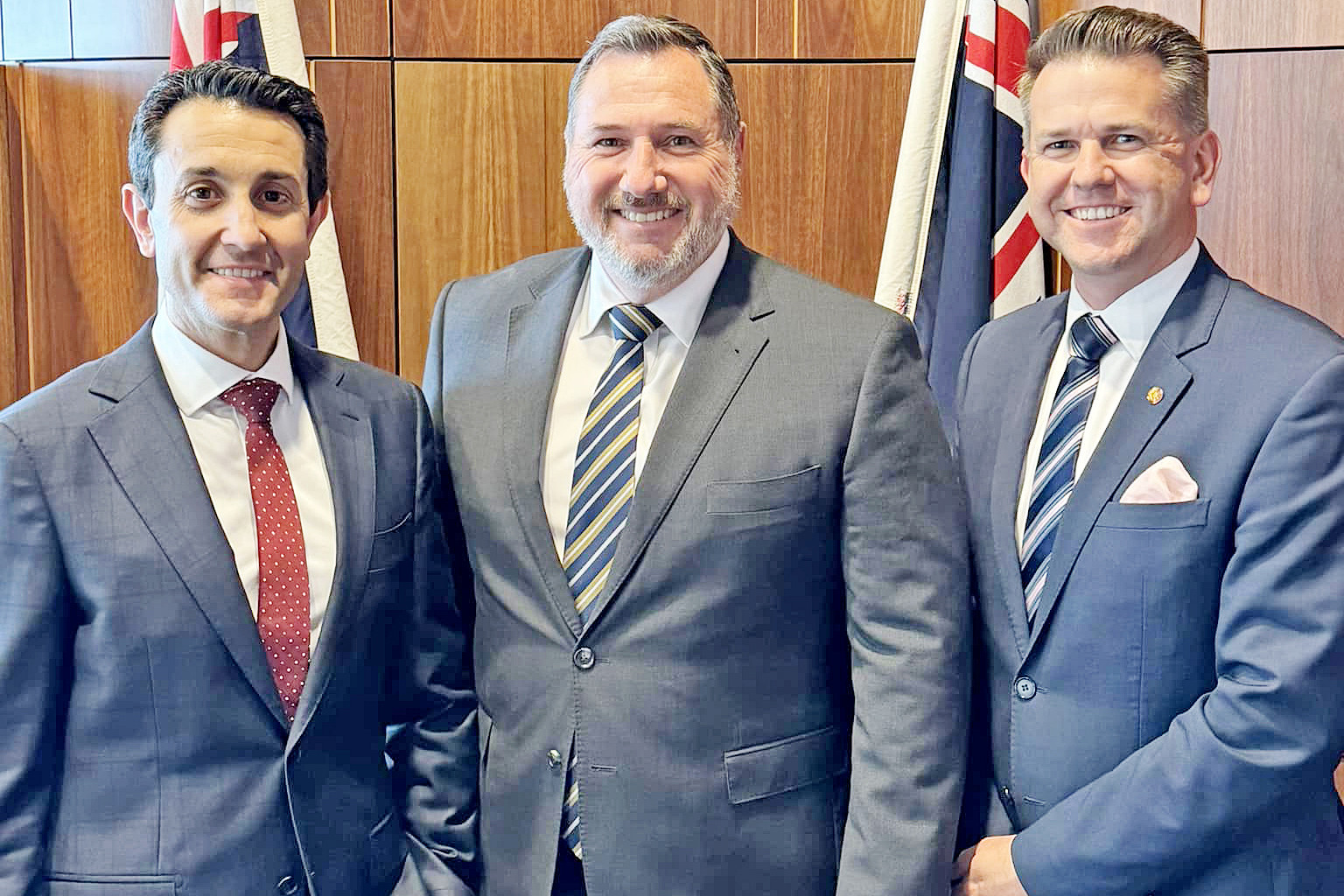

New Queensland Tourism Minister Andrew Powell declined to be interviewed.

In a statement, he said he was “concerned” that the rodeo had been placed into administration.

“We understand how important this event is for the Mount Isa community, and rodeo fans around Queensland and Australia,” Mr Powell said.

“As a priority, I will be meeting the administrator to discuss the event, and get a better understanding of the factors that have led to this decision.

“Once I have that information, we will consider what options are available to us in terms of supporting the event going forward.”

LEADERSHIP SLAMMED

THE report to creditors firmly put the blame on Isa Rodeo Ltd’s leadership and its financial management over several years.

“Over the period from 2019 to 2024 the company made several decisions that led to the deterioration of its financial position,” the report said.

“There is no evidence that management acted in any way other than in reliance upon appropriate business judgement.

“Regardless, these decisions, coupled with external pressures, led to the current financial position of the company.

“We have identified the following key failures:

The amount invested in entertainment expenses each year did not align to an increase in revenue.

An overreliance upon variable ticket sales in budgeting when very high fixed expenses were already locked in. A repeated “build it and they will come” survival strategy failed to increase profitability year on year and resulted in accumulated cash losses.

The decision to commence the Road to Rodeo series as a means of increasing the exposure of the Mount Isa Rodeo for long-term return was unsuccessful. Significant losses were incurred as a result of a weather event that effectively washed out the inaugural event.

The company’s expenses continued to increase materially year on year without a commensurate or tangible return on investment.

The Company employed extra staff in 2021.

Increased marketing and administrative expenses each year.

Material increases in the expenses of running the rodeo that have been classified in the account towards arena and grounds expenses.

“Due to multiple factors, at the time of our appointment it was apparent that the board and management no longer had the support of the Mount Isa community who are major stakeholders in the running and potential success of the Mount Isa Rodeo,” the report said.

SV Partners also criticised the decision to increase ticket prices by more than 50 per cent during a cost-of-living crisis.

“The decision to increase prices appears to have been done to try to stem the negative cashflow of the company, however strategically it was unsuccessful as attendance numbers were down and was one of the catalysts that led to the appointment of the administrators,” it said.

“The company has experienced continuing trading losses from the financial year ending 30 September 2019 and every subsequent period, with the exception of the financial year ending 30 September 2023 which reported a minor profit.”

Investigations revealed five potential preferential payments were made to one creditor.

“Preliminary investigations have identified that five transactions were paid to one creditor totalling approximately $176k after the estimated date of insolvency (and within the six-month relation back period) that may be considered an unfair preference should a liquidator be appointed,” the report said.

SV Partners did not reveal the creditor.